VWAP Tab

The VWAP (Volume Weighted Average Price) tab provides traders with essential insights into price action relative to trading volume. This powerful tool, combined with AI-driven analysis, offers a unique perspective on market dynamics and potential trading opportunities.

Key Features

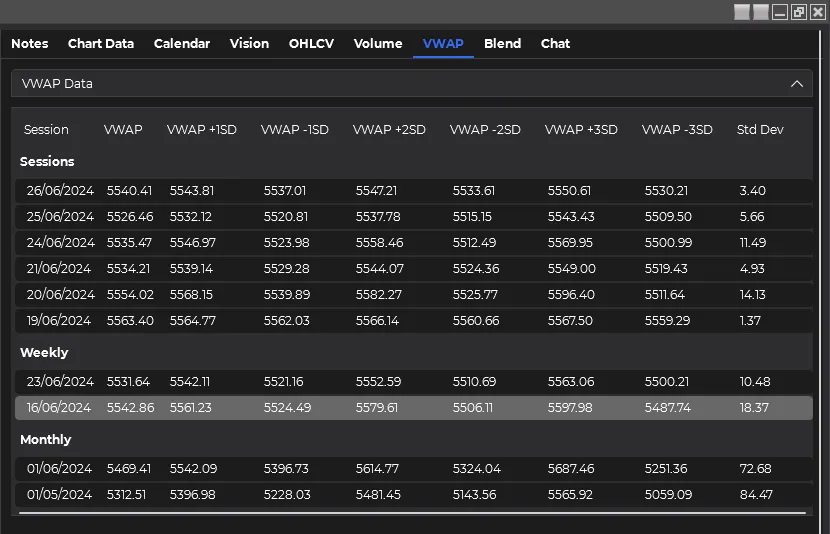

Multi-Timeframe Data Analysis

- Session Data: Intraday VWAP calculations

- Weekly Data: Extended analysis for short to medium-term trends

- Monthly Data: Broader context for longer-term price-volume relationships

Comprehensive VWAP Metrics

- VWAP: The core Volume Weighted Average Price

- Standard Deviation Bands:

- First Standard Deviation: Upper and lower bands (1σ)

- Second Standard Deviation: Extended upper and lower bands (2σ)

- Third Standard Deviation: Outer upper and lower bands (3σ)

- Standard Deviation Value: Measure of price volatility relative to VWAP

Using the VWAP Tab

-

Review Data Examine the VWAP data and standard deviation bands across different timeframes.

-

Formulate Prompt Craft a specific prompt to analyze aspects of the VWAP data. For example: “Analyze the relationship between price action and the first standard deviation VWAP bands over the past week.”

-

Select AI Model Choose your preferred AI model for analysis from the dropdown menu.

-

Initiate Analysis Click the “Analyze VWAP Data” button to submit your prompt and data for AI processing.

-

Review AI Response Read the AI’s interpretation and analysis of the VWAP data in the response section.

-

Convert to Speech (Optional) Use the text-to-speech feature to listen to the AI’s response.

Best Practices

- Leverage Multi-Timeframe Analysis: Compare VWAP and its bands across different timeframes to identify potential support/resistance levels and trend strength.

- Focus on Standard Deviation Bands: Pay attention to how price interacts with different standard deviation bands for potential entry or exit signals.

- Analyze Volatility: Use the standard deviation value to gauge market volatility and adjust your trading strategies accordingly.

- Combine with Volume Analysis: Ask the AI to analyze how VWAP relates to volume patterns for a more comprehensive market view.

- Look for Divergences: Request the AI to identify situations where price significantly deviates from VWAP and what that might imply for future price action.

Integrating VWAP Analysis with Other Tabs

The VWAP tab’s insights can be powerfully combined with other features in the application:

- Use VWAP insights to complement your chart analysis in the Vision tab

- Combine VWAP data with Volume Profile information for a more comprehensive understanding of price, volume, and value areas

- Cross-reference VWAP patterns with OHLCV data to understand how VWAP relates to traditional price action analysis

- Incorporate economic events from the Calendar tab to anticipate potential VWAP breakouts or reversals

By effectively utilizing the VWAP tab and its AI-powered analysis, you can gain valuable insights into market dynamics, potentially identifying key support and resistance levels, gauging trend strength, and understanding how volume is influencing price action. This information can be crucial for making informed trading decisions, particularly for intraday trading and for understanding longer-term price-volume relationships.

Advanced VWAP Strategies

- Mean Reversion: Use AI to analyze historical patterns of price reverting to VWAP and potential profit opportunities.

- Trend Confirmation: Ask the AI to evaluate how price position relative to VWAP can confirm or refute trend strength.

- Volatility Analysis: Explore how the spacing between standard deviation bands relates to market phases and potential breakouts.

- VWAP Anchoring: If your platform supports anchored VWAP, prompt the AI to compare different VWAP anchor points and their implications for trading.

- Volume Climax Detection: Request analysis on how extreme volume spikes affect VWAP and subsequent price action.

By mastering the VWAP tab and leveraging its AI capabilities, you can enhance your trading strategies with sophisticated price-volume analysis, potentially improving your trade timing and risk management.